Lower than one week in the past, Sonida Senior Residing (NYSE: SNDA) introduced a merger with CNL Healthcare Properties. The deal will function an “inflection level” to new progress, in keeping with the corporate’s leaders.

Sonida is below a $1.8 billion deal upsizing its senior residing portfolio to 153 owned unbiased residing, assisted residing and reminiscence care communities. Sonida additionally has acquired 23 property over the past 18 months.

With the strikes, Sonida is once more retaking a spot within the rankings of top-10 largest operators within the U.S. by unit rely. The deal is about to shut late within the first quarter or early within the second quarter of 2026 and “accelerates the corporate’s progress profile” and units the corporate up for even additional progress within the coming yr, in keeping with CEO Brandon Ribar.

“As soon as we shut and combine the CHP portfolio, we hope to return to this tempo of acquisitive progress,” Ribar stated throughout an organization earnings name. “The dedication of a brand new upsized $300 million revolver at shut of the transaction will additional enhance our obtainable capital to capitalize on our strong funding pipeline within the second half of 2026.”

Exterior of making ready for progress, Sonida has elevated its weighted common occupancy charge to 87.7% within the third quarter of the yr. As of the quarter’s shut, Sonida’s internet working incoming (NOI) margin reached 27.3% within the third quarter of 2025, representing a dip from the second quarter of this yr, when neighborhood NOI registered at 28.6%.

Sonida’s inventory is priced at $32.20, up 0.4% from the earlier shut.

Springboarding off the CNL merger

Following the closing of the cope with CNL Healthcare Properties, Sonida could have a extra versatile stability sheet and extra dry powder to transact in “progress markets the place constructing density doubtless is smart,” Ribar stated.

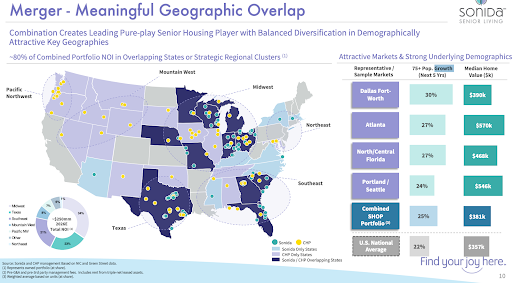

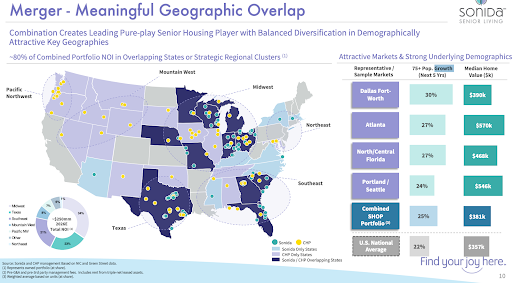

Sonida has grown in Texas, the Southeast and the Midwest and Ribar sees extra alternatives within the U.S. The corporate is presently concentrating on “disciplined inorganic accretive progress via acquisitions, joint ventures and third-party administration contracts ” within the U.S. Rocky Mountain and mid-Atlantic areas, complementing CNL Healthcare Properties’ present footprint.

Sonida Senior Residing 3Q investor presentation

Sonida Senior Residing 3Q investor presentationSonida’s technique trying forward is to construct itself up below an “proprietor, operator, investor” mannequin whereby the corporate’s regional clusters and density give it the power to raised handle its communities.

The corporate’s leaders imagine the operator has a singular market area of interest as one that mixes elements of each actual property funding trusts (REITs) and operators. Additionally they are sustaining stability sheet flexibility with a purpose to reap different alternatives forward.

The corporate’s market place affords it a number of advantages, together with the power to lean on native and regional working constructions, enhanced market data and experience, operation synergies, flexibility to handle staffing wants throughout native and regional portfolios and a wider management and growth pool to help expertise retention and progress.

Progress in outcomes

Sonida is rising not solely via acquisitions, however by notching neighborhood operational enhancements.

Sonida has labored to restructure its labor power, lowering turnover and growing stability in native management on the neighborhood degree has helped handle labor prices with extra constant wage progress. New scheduling methods and clearer communication helps employees with extra dependable info on resident wants and improves response instances as effectively, in keeping with Ribar.

“We proceed to expertise significant reductions in employees turnover on a yr over yr foundation which additionally helps robust care and companies for our residents,” he stated.

Sonida has managed to virtually get rid of contract labor from its workforce as effectively, now registering at only a fraction of labor bills.

As the corporate continues to develop, Ribar added he’s assured the corporate will “proceed to draw prime notch expertise with a dedication to offering prime quality care and companies to our residents.”

Amongst Sonida’s prime priorities over the previous yr has been stabilizing the 19 communities it acquired in 2024. These communities noticed a 370 foundation level enhance from the second quarter to the third this yr, reaching a mean of 83.7%.

Sonida grew resident charges 4.2% for these communities, in keeping with Ribar.

Ribar added this type of efficiency in integrating communities into its working platform additional will increase the corporate’s confidence in its skill to execute on the “extra complicated and scaled transaction” via its merger with CNL Healthcare Properties.

Shifting extra {dollars} to the corporate’s advertising and marketing group has created a wider, extra constant gross sales funnel, in keeping with Kevin Detz, chief monetary officer of Sonida.

Sonida additionally has continued to concentrate on inside gross sales lead whereas lowering reliance on third occasion referrals, with a lower of placements from 43% to 26% yr over yr. Digital advertising and marketing efforts led to a rise in each lead quantity and high quality of referrals, Ribar advised Senior Housing Information. Gross sales employees additionally acquired extra coaching, and the operator skilled robust demographic traits in its “robust progress markets.”

Nonetheless, occupancy traits as an entire had lagged behind business averages by round 200 foundation factors earlier this yr, and many of the portfolio’s progress occurred within the again half of the third quarter, in keeping with Ribar.

“We’ve seen the mix of a discount in transfer out via dying after which a rise in move-ins that we’re producing via our personal inside mechanisms, that in the end is useful from simply an general margin and progress perspective,” Ribar stated. “We’re happy to be knocking on the doorstep of 90% however we all know that continued progress and margin flow-through are absolute areas of emphasis for us as we shut the yr.”