Senior dwelling traders are nonetheless favoring assisted dwelling properties in 2026 as valuations surge, however there are indicators that neighborhood pricing is returning nearer to equilibrium.

That’s in line with a brand new Cushman & Wakefield survey analyzing market circumstances within the first half of 2026. The report, launched Feb. 6, is predicated on responses from greater than 75 senior dwelling and care professionals.

Initially of a brand new 12 months, the senior dwelling business has the wind to its again with regard to demand. Senior dwelling occupancy is nearing 90% in 2026 after internet absorption outpaced provide progress by 4.8 to 1 in 2025, in line with NIC MAP information cited by the report’s authors. Consolidation, adopting new expertise and a “slight softening” in labor markets helped operators strengthen margins final 12 months.

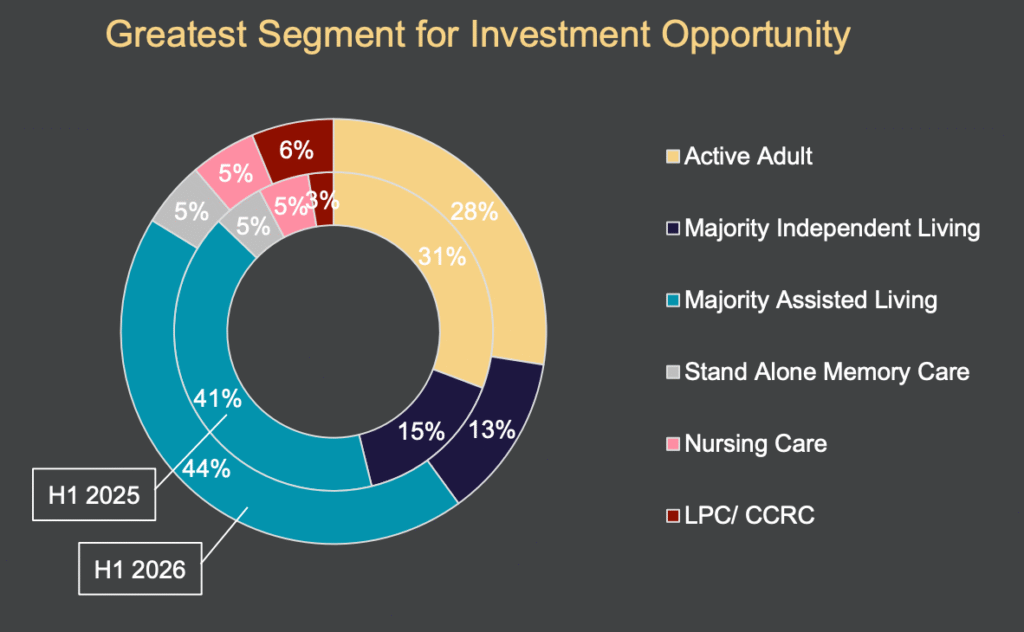

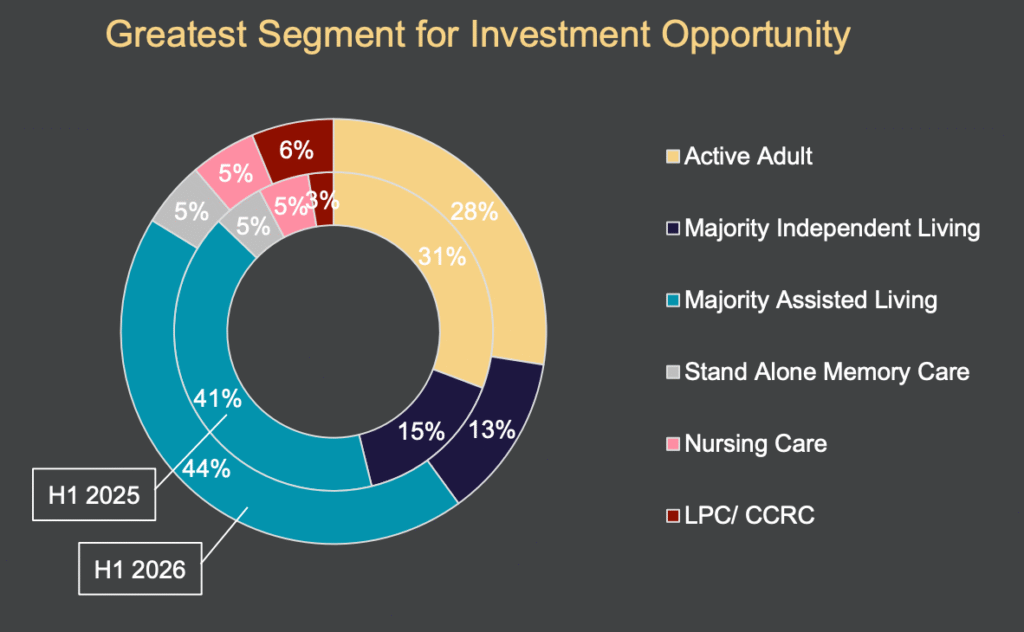

Traders are in 2026 favoring assisted dwelling, with 44% figuring out the product sort as their prime funding alternative in 2026, representing a slight acquire over 2025, when 41% of respondents stated the identical. Greater than 1 / 4 of the survey’s respondents (28%) fingered lively grownup as their prime alternative for funding, representing a slight lower over the earlier 12 months.

Half of respondents within the newest survey see core-plus acquisitions as their most compelling funding technique, whereas 28% stated the identical about value-add acquisitions. Virtually three-fourths of the respondents (72%) stated they weren’t prepared to underwrite destructive leverage, a stark acquire over final 12 months, when 48% stated the identical.

“Although opportunistic/distressed methods are nonetheless sought out by traders, restricted alternative for this technique has materialized, resulting from lender exercises and favorable property market efficiency,” the survey’s authors wrote. “The survey outcomes additional point out a big discount of destructive leverage in investor underwriting, signaling that pricing is starting to return to equilibrium, pushed by favorable property market developments with elevated NOI and a extra favorable value of capital.”

Greater than a 3rd (37%) of the respondents see staffing as a prime threat to valuations within the subsequent 12 months, whereas greater than 1 / 4 (29%) stated the identical about rates of interest. On the identical time, 71% of respondents stated they assume cap charges will lower within the coming 12 months.

“Not solely is that this a robust indication that valuations have bottomed, survey outcomes additional point out the return of investor confidence within the sector,” the report’s authors wrote.

The return of contemporary capital and a basic enhance in debt liquidity is driving “a really aggressive funding marketplace for the sector,” and “signaling a swift shift from a purchaser’s market to a vendor’s market.”