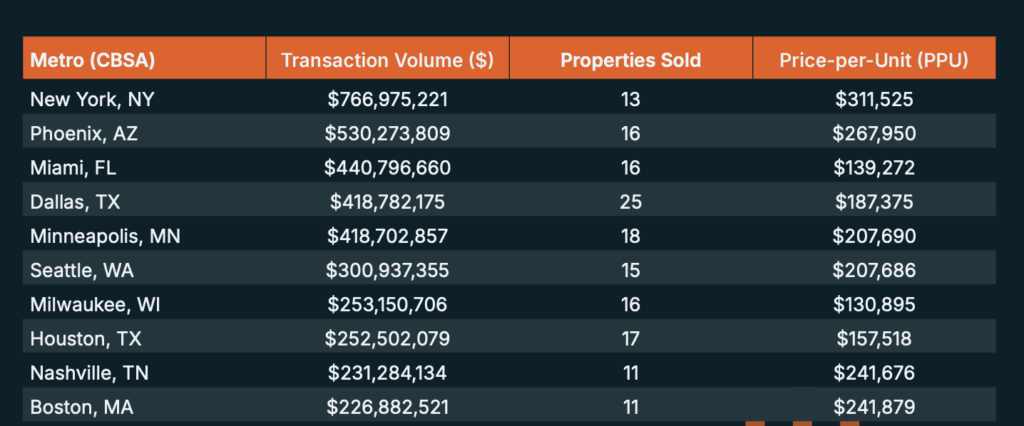

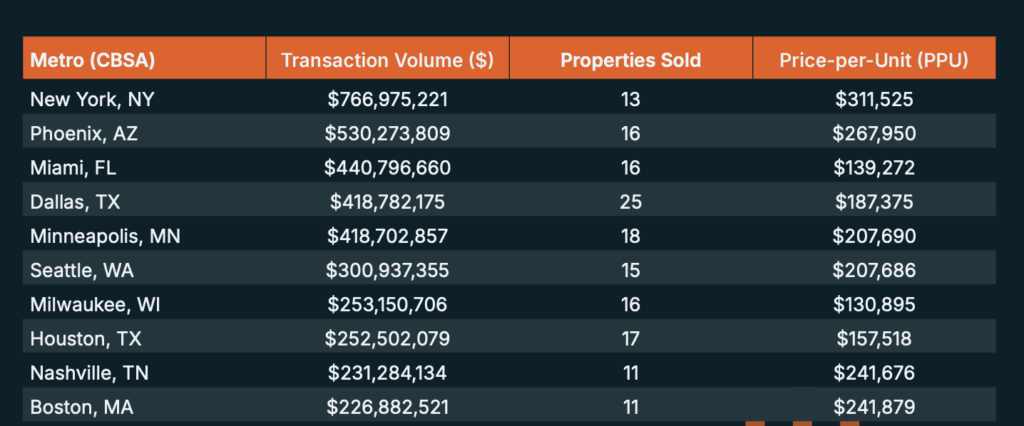

New York Metropolis, Phoenix, Arizona, and Miami had been the top-three locales for senior housing investments through the first three quarters of this 12 months, in accordance with a brand new NIC report.

In a report launched Dec. 11, NIC researchers detailed the geography of the greater than $16.3 billion senior housing and care transactions in 2025, greater than $5 billion in comparison with the earlier 12 months. Senior housing accounted for greater than $10.3 billion of that whole.

In New York Metropolis, round $766 million modified fingers throughout 13 properties, promoting at a price-per-unit of $311,525, in accordance with the NIC report. Dealmakers in Phoenix, Arizona, notched$530 million in transaction quantity with 16 properties offered at a price-per-unit of $267,950, adopted by Miami with $440 million in transaction quantity by 16 properties offered at a price-per-unit of $139,272.

Picture courtesy NIC MAP

Picture courtesy NIC MAPWithin the first three quarters of 2025, the common deal price-per-unit rose to $175,000, a 43% improve versus the identical interval in 2024 and marking six months of steady progress. Greater than 1,000 properties modified fingers, a 7% improve from the earlier 12 months.

“The info paints a transparent image of a market that’s regained its footing,” Arick Morton, CEO of NIC MAP, mentioned in a press launch. “Transaction exercise, pricing momentum, and capital curiosity are all accelerating. Senior housing has emerged from a correction interval stronger and extra enticing to traders looking for steady, long-term progress alternatives.”

The traits counsel the business will proceed to put up robust returns and proceed to draw extra capital, which can help the business’s efforts to fulfill rising demand, Morton instructed Senior Housing Information.

“Investor conduct in the present day displays conviction within the sector’s fundamentals,” Morton continued. “As demographic demand accelerates and working metrics enhance, senior housing stays a compelling alternative within the broader industrial actual property panorama. The transaction information tells us the place traders are getting ready from progress. Now we want growth to comply with as a result of we merely don’t have sufficient senior housing within the pipeline.”

Whereas the investor pool continues to broaden, there are nonetheless considerations a couple of projected shortfall. Primarily based on NIC MAP information, the U.S. is dealing with a 550,000-unit shortfall in senior housing by 2030, representing a $275 billion funding scarcity, in accordance with the discharge. To handle it, the business might want to “greater than triple its present growth tempo to fulfill surging demand from the 80+ inhabitants.”

“A strong acquisition market with growing volumes and costs will be anticipated to assist open up the event market. As acquisition costs start to exceed substitute price, this creates growth yield, which helps broaden growth,” Morton mentioned. “A robust and rising acquisition market is vital to unleashing the animal spirits of growth wanted to fulfill the rising demand.”