This story is a part of your SHN+ subscription

The lively grownup sector has considerably expanded in the previous few years, however a current NIC report reveals there may be nonetheless rather more room for development on the horizon.

New information launched by the Nationwide Funding Middle for Seniors Housing & Care (NIC) earlier this month caught my eye. In response to the business affiliation, there are at the moment 800 lively grownup properties housing 118,000 models within the U.S., which carry a mean stabilized occupancy fee of 96%. That demand, plus the nonetheless comparatively small dimension of the lively grownup sector in comparison with the senior residing business’s greater than two million senior residing models, tells me there may be rather more room for development for these firms. And certainly, that was the conclusion of NIC Senior Principal Caroline Clapp, who mentioned that “the lively grownup rental market continues to be in its early phases” with common penetration charges of solely as excessive as 2% in sure markets.

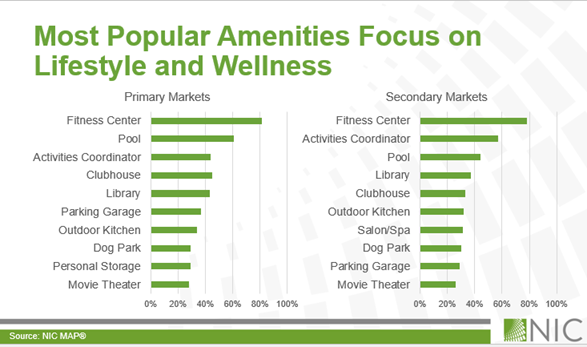

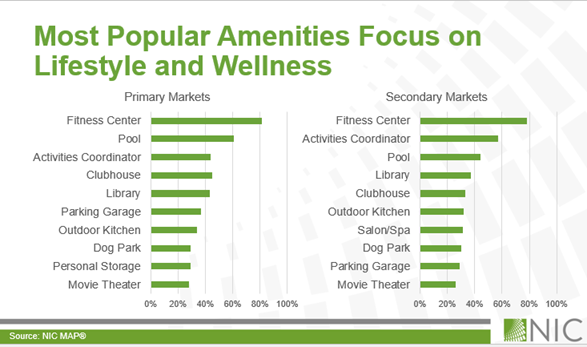

Final yr, SHN Senior Editor Tim Regan coated how lively grownup operators are divining the wants and desires of youthful older adults and providing them facilities and providers they want. Residents most frequently want health facilities, swimming pools, clubhouses, and actions coordination, indicating “sturdy curiosity in life-style, engagement, and wellness,” Clapp wrote in NIC’s current report.

Lively grownup communities are also cheaper than some other rung on the senior housing care continuum, with median charges in giant metro areas between just under $2,500 in Denver to about $3,500 in Miami.

Placing all of the items collectively, I feel lively grownup communities nonetheless have a powerful worth proposition among the many incoming boomer technology, simply as they’ve in recent times. Longer-term, I feel the product sort’s present demand underscores the problem that senior residing operators elsewhere on the continuum may need when these residents want the next stage of care within the years to come back.

On this members-only SHN+ Replace, I analyze current NIC MAP information and different current reporting to supply the next takeaways:

- Inside the expansion of the lively grownup market in 2025

- The driving forces behind rising lively grownup demand

- Why senior residing operators might battle to draw present lively grownup residents down the highway

Lively grownup demand continues to surge as sector grows

The lively grownup product sort has surged with demand within the final 12 months. Evaluating NIC MAP information from final October and now, the business has added about 2,000 lively grownup models, a barely greater quantity than the 1,890 senior residing models that got here on-line in that point.

Firms forging forward within the lively grownup area embody United Properties, which is including 30 new villas to its Amira Villas Minnetonka lively grownup group in Minnetonka, Minnesota. United Properties opened the group in 2023 and had initially deliberate for an prolonged keep resort on the location of its new villas, however shifted these plans primarily based on red-hot demand for the product sort, in line with Vice President of Senior Residing Improvement Dave Younger.

“We really feel it’s offered a distinct segment out there for an ever-growing demographic so we’re persevering with to pursue the Amira product within the Minnesota and Colorado markets,” Younger advised SHN in January.

Equally, developer Avenue in April opened its first Viva Bene group in St. Louis, with plans to broaden the model from there. The model’s mannequin rests on pairing lively grownup models and a wellness hub with resident entry to preventative well being due to a partnership with Sevi Well being.

“Viva Bene adjustments the senior residing paradigm by incorporating early entry to care navigation and continual care administration. It’s about proactive prevention and infusing wellness into on a regular basis life so individuals can thrive,” Viva Bene co-founder and Avenue principal Laurie Schultz mentioned on the time.

Each firms’ fashions are aimed toward attracting older adults who need to lease reasonably than personal a house or make an early transfer into unbiased residing.

It’s not exhausting for me to think about why lively grownup operators have grown these sorts of fashions for the boomer crowd. Older adults between the ages of 65 and 74 made up about 10% of whole renters in 2023, representing the fastest-growing age group amongst older grownup renters. NIC famous there’s a “notable rise in grey divorce” amongst older adults 50 years outdated or older, after which they’re extra prone to lease an condo than transfer into senior housing.

Older adults of the newborn boomer technology additionally want facilities that emphasize life-style and wellness, comparable to health facilities, swimming pools, clubhouses, libraries and canine parks. And they’re now the wealthiest technology by way of median internet value, with a median internet value of just a little greater than $200,000. That’s “additional fueling demand for high-quality properties with resort-like facilities,” in line with Clapp.

Lively Grownup Rental Communities: Knowledge Dive by way of NIC MAP

Lively Grownup Rental Communities: Knowledge Dive by way of NIC MAPMoreover, these merchandise are newer on common than their senior residing counterparts, with a median group age of 10 or fewer years outdated in comparison with senior residing communities, which carry a median age of 21 years. Roughly a 3rd of all lively grownup communities have opened since 2020, in line with NIC MAP.

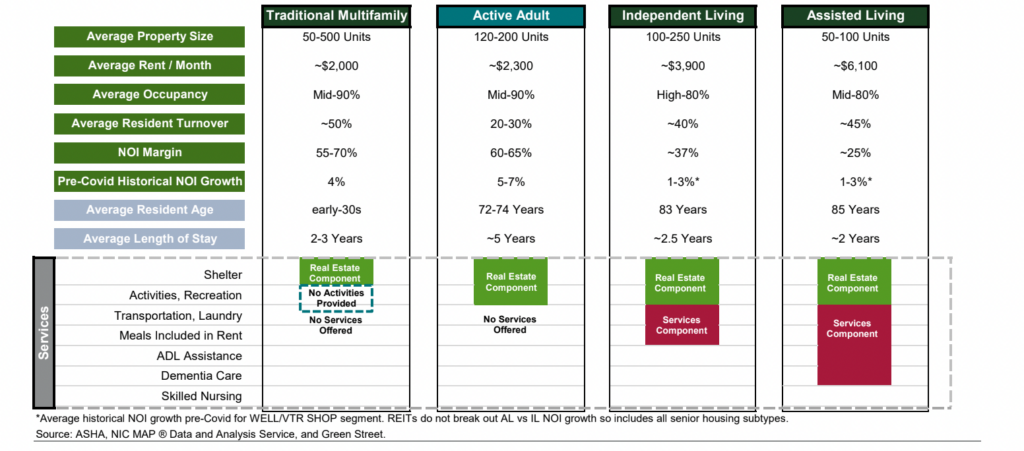

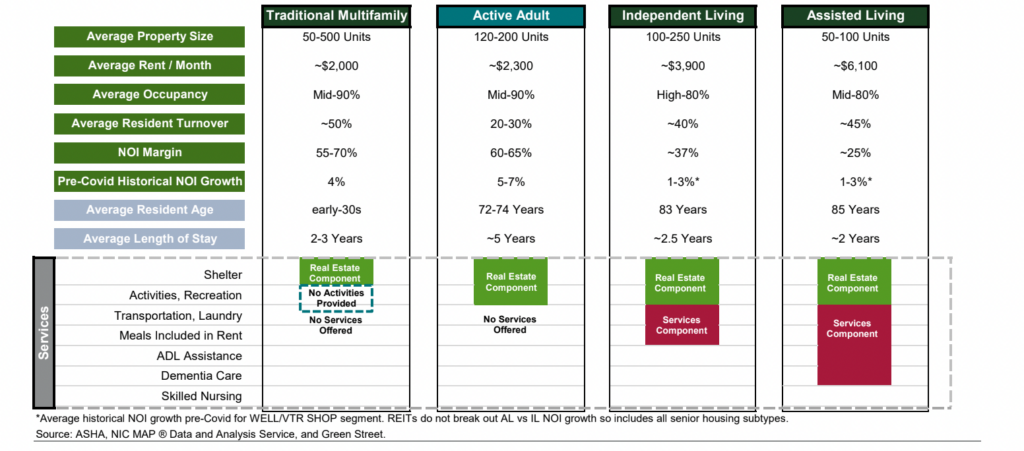

Whereas they provide residents far fewer providers, lively grownup communities are cheaper than unbiased residing communities. In response to NIC information cited by ASHA’s The place You Dwell Issues web site, the typical value of unbiased residing within the U.S. is round $3,800 monthly. That’s nonetheless greater than the costliest common month-to-month lease for an lively grownup unit of$3,500 monthly in Miami.

Different markets carry month-to-month lease even decrease than that. On common, lively grownup models in San Antonio, Texas, and Denver, all charged lower than $2,500 monthly. In response to a 2024 Inexperienced Avenue report, lively grownup rents “garner a 30% [to] 50% low cost and supply a a lot greater NOI margin because of the lack of providers and operational depth relative to senior residing.”

July 12, 2024 “Well being Care Insights” report from Inexperienced Avenue

July 12, 2024 “Well being Care Insights” report from Inexperienced AvenueIn response to Inexperienced Avenue’s evaluation, greater than three-fourths of potential lively grownup residents can afford their lease with out counting on financial savings.

“With 80% to 90% of residents usually retired, and a majority of these receiving social safety retirement advantages (~90% of retirees obtain advantages), the power of residents to pay for lively grownup communities screens fairly favorably,” the Inexperienced Avenue report reads. “De minimis unhealthy debt, whatever the financial surroundings, makes it a reasonably defensive property sector relative to most.”

Placing the entire items collectively, it’s clear to me that the lively grownup sector has an extended runway for development within the years forward and plenty of room to develop, and that was additionally Clapp’s opinion.

“Penetration charges are nicely beneath these of conventional senior housing, indicating potential alternative for additional improvement relying upon the market and submarket,” she wrote. “Buyers and builders ought to conduct in-depth analysis and guarantee thorough due diligence when coming into a brand new market, striving to maintain life-style and engagement on the core of lease-up and operations.”

A standard chorus in senior residing is that right now’s unbiased residing is yesterday’s assisted residing. I feel that mind-set additionally applies to the lively grownup sector, which right now resembles the business’s unique unbiased residing mannequin born within the ‘90s.

Little doubt these situations are good for lively grownup firms with well-thought plans. However I additionally suppose lively grownup development might squeeze unbiased residing operators, which in 2025 are reporting that residents who used to maneuver into unbiased residing at the moment are skipping over the product sort totally.

The challenges of differentiation

Whereas they’re pretty completely different from each other by the use of providers, unbiased residing and lively grownup operators are nonetheless related sufficient that they’ll appeal to lots of the identical prospects.

I see two huge challenges arising out of that pattern for unbiased residing operators: that residents will age in place in lively grownup communities, and that future child boomers might select to skip unbiased residing for the next stage of care as soon as they want it.

For instance, residents transfer into Scottsdale, Arizona-based Cogir Senior Residing’s communities at a later stage than they did previous to the Covid-19 pandemic. As they accomplish that, they’re bypassing unbiased residing and transferring into assisted residing or reminiscence care, in line with COO Gottfried Ernst.

Whereas that pattern isn’t immediately associated to lively grownup communities, I feel an identical phenomenon might play out in lively grownup because the product sort grows. As SHN has written about earlier than, I feel there’s a risk that residents will age in place for so long as they’ll, given the decrease value of that setting and their want for independence. Then, after they can’t reside of their flats anymore, they may transfer into assisted residing or one other care stage.

To be clear, Inexperienced Avenue believes “acuity creep” – because the phenomenon is named – is simply a “low” danger for lively grownup firms. However I feel that the rise of lively grownup makes it much more essential for unbiased residing and different operators to distinguish their providers as a lot as attainable.

One current pattern is mixing unbiased residing with extra proactive wellness or preventative well being providers. Residents of these sorts of communities wouldn’t essentially transfer into them due to lovely grounds, luxurious meals or different facilities, and as a substitute select them for the way efficiently they may help residents preserve wellness within the years to come back or how they’ll make them really feel “at residence.”

Complicating that’s the truth that senior residing communities are ageing and rising extra out of date whereas improvement stays at a near-standstill. That’s to not say operators gained’t be capable to differentiate themselves from newer, probably extra enticing lively grownup communities, however my level is that unbiased residing operators doubtless must be artistic so as to stand out sooner or later.