This story is a part of your SHN+ subscription

In 2026, senior dwelling improvement exercise stays on the fringes, with few indicators that can change any time quickly. However progress by way of new-build is now not less than on the thoughts of traders and capital companions as demand for senior dwelling swells.

Operators are consequently rising in locations “you possibly can’t even discover on the map” and dealing with well-established inner improvement wings to safe websites for growth.

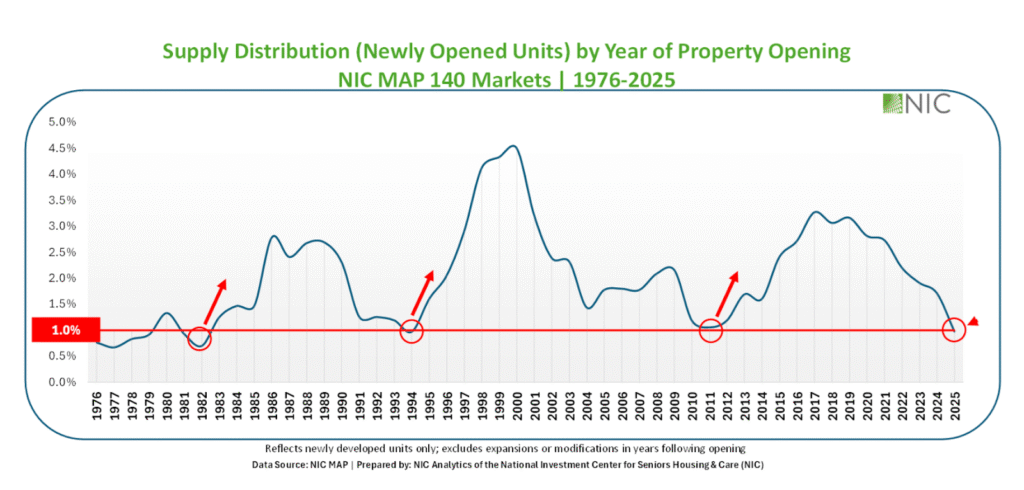

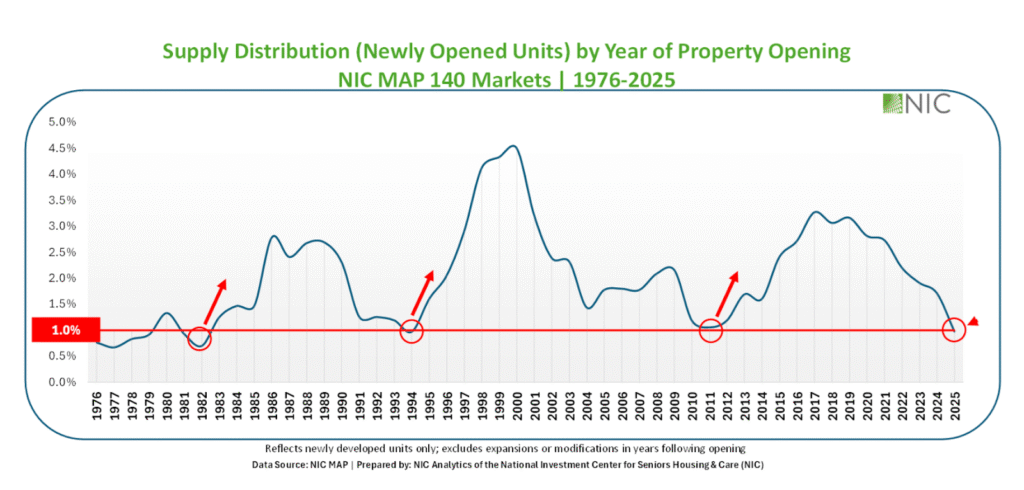

Nationwide Funding Middle for Seniors Housing & Care (NIC) Senior Principal Omar Zahraoui famous that the business is within the “early innings of the following provide cycle.” Traders, house owners and builders of recent initiatives are centered on “attempting to catch up” to demand slightly than getting forward of it, as they did throughout its most up-to-date improvement cycle between 2011 and 2019.

Quite than a “construct it and they’re going to come” mentality, senior dwelling improvement in 2026 and past shall be a “show it earlier than you construct mentality,” Zahraoui instructed me.

As he identified final 12 months at BUILD, historical past exhibits that when new stock progress falls to roughly 1% of complete senior dwelling properties, a brand new improvement cycle is more likely to happen inside 5 years.

Senior dwelling corporations have realized from earlier cycles and thus should not within the mindset of “construct it and they’re going to come,” based on Senior Dwelling Funding Brokerage Senior Managing Director Ryan Saul. As an alternative, they’re counting on previous improvement relationships and placing higher emphasis on market analysis, together with particular unit mixes.

“The business is getting so much smarter in what initiatives the market can bear,” he mentioned.

For years, a excessive price of improvement and a comparatively low price of acquisitions in comparison with alternative has pushed senior dwelling house owners to purchase as an alternative of construct. In 2026, some “keystone offers” are transacting at or above alternative prices, Richard Swartz, JLL’s senior housing platform co-leader, instructed me final month. If that development continues, it’s an indication that new improvement will turn into extra favorable from a monetary price foundation.

In fact, even when new initiatives are began at the moment, they face a timeline of greater than two years to completion. So, even when the event ramp-up happens in 2026, these communities gained’t considerably open till 2028. However any signal of a improvement pickup will come as excellent news in mild of the senior dwelling business’s ever-widening “funding hole” of quick provide and rising demand.

On this week’s unique, SHN+ Replace, I analyze present improvement situations and supply the next takeaways:

- How senior dwelling corporations are getting “smarter” with new initiatives

- Growth implications from transaction alternative price dynamics

- How and when new improvement exercise would possibly return

Ebb and stream on alternative prices, conversations ‘beginning to change’

In 2026, senior dwelling improvement continues to be comparatively frozen.

Within the third quarter of 2025, occupied senior housing models elevated from roughly 630,000 to almost 635,000 models within the fourth quarter. Throughout 31 NIC Main Markets tracked by NIC MAP, occupied models elevated by roughly 20,000 in 2025, a 3% improve in comparison with 2024.

However there are indicators that would change quickly because of evolving pricing for M&A in relation to improvement. In 2026, there are offers pricing above alternative, “generally materially so,” JLL Senior Managing Director and Co-leader of Senior Housing Jay Wagner instructed me this week. To date, these offers are restricted to main markets that carry excessive common occupancy and income. And it’s no secret that initiatives with stable professional formas are nonetheless engaging to traders and capital companions. Belmont Village CEO Patricia Will mentioned in the course of the current BUILD convention that “the speed that we are able to cost for the worth that we ship allows us to proceed safely underwriting new developments.”

“Whether or not there are folks on the different finish of this who’re keen to lend is determined by whether or not it underwrites,” she mentioned.

A bigger challenge is the present lack of investor fairness for brand spanking new initiatives. As a result of that, the “bulk of the market” continues to commerce “properly beneath” alternative prices proper now, Wagner mentioned.

From a pattern of 100 transactions dealt with by SLIB in 2025, “there could have been one” that traded above alternative prices, Saul mentioned.

However, on the identical time, building debt financing situations have “continued to enhance” regardless of excessive building and labor prices, each Saul and Wagner instructed me.

“It’s nonetheless far off, however it’s beginning to change as a result of improvement is inevitably moving into the dialog now,” Saul instructed me.

Any uptick in improvement is straight tied to present property values, building prices and lender urge for food.

“It is not going to be till performing property positioned in prime markets have occupancy and money stream that leads to values beginning to exceed or not less than be nearer to alternative prices will we begin to see improvement decide up,” Saul instructed me.

These conflicting situations are nonetheless largely encouraging as a result of it exhibits that improvement is not less than again in finance-related conversations and in some circumstances, sure transactions at the moment are certainly buying and selling above alternative prices.

Traders, operators have to be ‘extra diligent’ to develop new

Getting improvement achieved at the moment takes extra front-end work, from coping with hassle accessing building debt to tough building and labor prices threatening venture plans.

Development prices in early 2026 are much like the degrees the Weitz Firm reported final 12 months, the primary version of its Senior Dwelling Development Prices report exhibits from earlier this week.

To get initiatives achieved in 2026 and past, improvement corporations and operators have to be “extra diligent” to find the best market, Saul instructed me.

“Many are ready for it to be price efficient and a few are ready for it to be market-driven,” Saul added. “If prices weren’t an element, then you could possibly construct it and look forward to the demographics to catch up.”

However the present demographic “wave” on the business’s doorstep gained’t wait on capital markets to abdomen riskier building financing. These situations require taking over extra danger: soar in now to be first capitalizing on demand, or maintain till market situations demand improvement.

I take a look at operators together with Expertise Senior Dwelling and Constitution Senior Dwelling, two corporations which have undertaken previous improvement. Constitution has lately focused tertiary-market improvement, and Expertise has focused main market improvement in Washington, D.C., and Denver, each metro areas which have seen continued progress regardless of a improvement dearth.

These are each viable however contrasting methods via chasing main market demand or wading into tertiary market alternatives the place competitors is lighter and offers can work primarily based on purpose-built group designs.

Operators like Constitution and Cedarhurst Senior Dwelling proceed to maneuver with agility in much less populous markets. In December of final 12 months, Cedarhurst entered Iowa with its first deliberate group that’s set to open in 2027. For these two operators, tertiary markets are one of many few locations the place prices, land availability and rental charges can succeed.

Different operators are specializing in progress inside statewide networks, together with Kingsbury Dwelling, which opened its first $28 million group in Lancaster, Ohio final fall. One other Midwest-based operator, Silver Birch Dwelling, began its first Ohio improvement final 12 months as the corporate has its sights set on a number of new, reasonably priced senior dwelling communities in Ohio within the coming years, CEO Jo Ellen Bleavins instructed me in 2024.

“When the spigot does flip again on, the offers that can get achieved shall be with skilled teams which have lengthy standing capital relationships on the fairness aspect,” Berkadia Seniors Housing & Healthcare Managing Director Cody Tremper instructed me.

These extra focused efforts in improvement present that improvement is feasible in a difficult time, however requires extra slender venture designs and a few previous improvement expertise. Those who hold their improvement groups collectively, no matter if there are shovels within the floor or not, may also be forward of teams that disband improvement efforts altogether.

“Lots of these teams at the moment are simply beginning to shift again and begin eager about it,” Wagner mentioned of improvement prospects in 2026.

NIC information exhibits the common venture takes roughly 29 months to finish, which means that initiatives beginning at the moment more than likely gained’t open earlier than subsequent 12 months or 2028, Zahraoui wrote.

A “broader shift” in senior dwelling improvement might come “roughly two to a few years away,” he mentioned. That’s as a result of longer building timelines, greater price of capital and extra strict underwriting, he instructed me.

“The most important problem is restoring improvement margins. Feasibility stays considerably a problem. Till venture economics persistently compensate for building danger, improvement will seemingly stay constrained,” Zahraoui instructed me.

So when senior dwelling improvement returns, I’m assured will probably be a focused effort that’s led by sturdy operators much less involved about swinging for the fences in a house run derby, and extra centered on making regular, repeated contact in 2026.